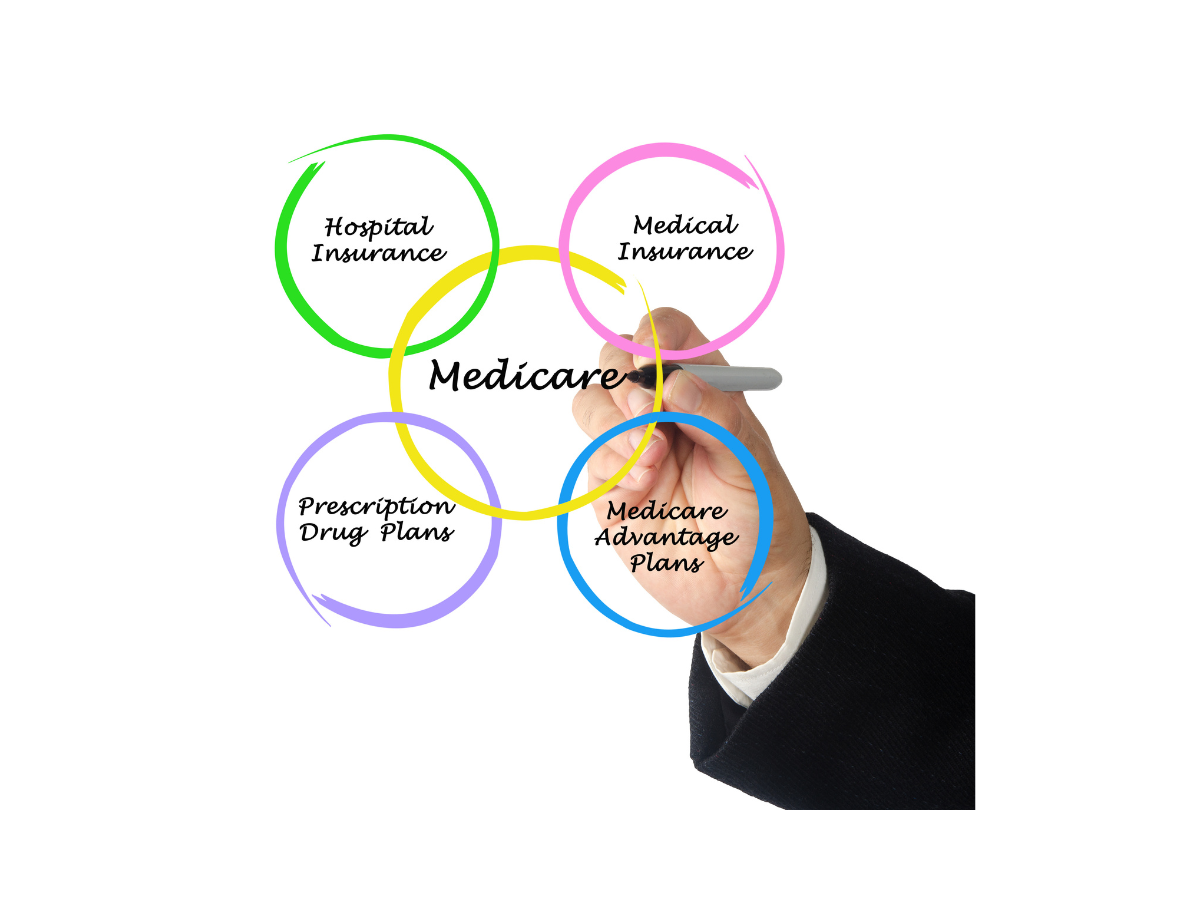

For starters, it is a Federal Health Insurance program that came about in 1965 as a result of a Bill signed by then President Lyndon Johnson to go with Social Security. The original program provided coverage for the Hospital (Part A) and Medical (Part B) which is why these two parts are referred to as “Original Medicare.” In addition to those individuals 65 and above, it has been expanded over time to include disabled people and people with end stage renal disease (ESRD), that may require a transplant or dialysis. For those individuals signing up for Medicare, “Original Medicare” provides the following coverages.

Medicare Part A- Hospital-

Medicare Part A coverage covers an “Admitted Hospital Stay.” Medicare will cover semi private rooms, drugs, nursing, meals and Hospital services associated with the stay. Medicare does not cover a private room, TV or phone(if not included), private duty nursing and personal care items. Hospital Part A also covers time in a Skilled Nursing Facility (SNF). The SNF will be available after a Hospital related condition following a 3 day Hospital Stay.

Skilled Nursing services include-

Meals, Skilled Nursing Care, Semi Private Room, Physical, Speech, Occupational Therapy, Medications and Medical Supplies, Ambulance and Dietary Counseling.

Medicare Part A Costs-

Most individuals when nearing retirement age that have worked for more than 10 years or 40 Quarters will be entitled to Free Medicare Part A. If you worked less than 40 Quarters you will pay a monthly premium for your Part A Hospital coverage. For example in 2024-

-If you worked between 30 to 39 Quarters then your Part A premium will be $278.00 per month.

-If you worked 29 Quarters or less your Part A premium will be $505.00 per month.

Hospital Part A offers coverage for an Inpatient Hospital stay and time spent in a Skilled Nursing Facility following an Inpatient Hospital stay. An Inpatient Hospital stay is broken down into 60 day benefit periods. If you have to return to the Hospital for the same condition within 60 days the cost share will not apply. The costs are as follows:

Days 1- 60- Individuals will be responsible for a $1632 deductible.

Days 61- 90- $408.00 Per Day

Days 91- 150- $816.00 Per Day (Utilizing the 60 day Lifetime Allowance)

Days 151 and beyond- All Costs

Skilled Nursing Facility-

Following an Inpatient Hospital stay Medicare will cover 20 days. The costs are as follows:

Days 1- 20- $0 per day

Days 21- 100- $204 per day

Days 101 and beyond- All costs

Medicare Part B- Medical

Medicare Part B covers services outside of an admitted Hospital stay that are both “Preventative” and “Medically Necessary.” Medically Necessary services include services and/or supplies needed to treat a condition or illness. Preventative services are to prevent illnesses and conditions at no cost to the Medicare beneficiary from a provider that accepts Medicare. Medicare does not cover Medications. Prescriptions are available through a Part D Prescription Drug plan offered by a private insurance carrier. Medicare does cover injectable medications administered in a Doctor’s office or Facility.

Medical Part B Costs–

Part B Monthly Premium- The Base Monthly Premium for 2024 is $174.70 depending upon income. Some will pay a higher amount-

Income Related Monthly Adjustment Amount (IRMAA) – Some individuals will pay a higher monthly premium due to a higher annual income. For 2024 the base annual income for a single filing individual is $103,000 or less and $206,000 for couples filing jointly. Any amounts above will result in a higher monthly premium and an increase in their Part D monthly premium. Social Security looks back 2 years so for some, their income is not being correctly represented resulting in a higher monthly premium based on wrong information. If your income has gone down you are able to get your monthly premium lowered by filing a “Life Changing EventForm.”Please see the Income Chart Below. You can also download the adjustment form from our documents library, there is a link below as well.

Additionally, Medicare Beneficiaries will have cost sharing when using Medicare Part B services. They are as follows:

Part B Deductible– $240.00. Individuals will be responsible for the first $240.00 of their Medical coverage. This is an annual deductible and only paid once.

Part B Coinsurance– 20%- Once the deductible is satisfied Medicare will pay 80% of all approved amounts and the Medicare Beneficiary will be responsible for 20%.

Medicare Health Insurance-

Another development of the years is the availability of insurance coverage to help cover the costs associated with Original Medicare. The first to come along were Medicare Supplement plans, known as Medigap. These were designed to help pay your Medicare cost share and usually come with a premium and a separate Part D Drug plan must be added. The next plan to help with these costs is Medicare Advantage, or Medicare Part C. These are more of the traditional type of plans, HMO’s, PPO’s etc. and offer additional items not offered by Original Medicare such as Dental and Vision.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.